Title loans for freelancers offer flexible funding in bustling cities like Fort Worth, providing immediate access to capital using vehicle titles as collateral, bypassing credit checks, and empowering non-traditional workers with financial relief during unpredictable work periods or emergencies.

Title loans for freelancers offer a unique financial safety net for nontraditional workers grappling with unpredictable income streams. This alternative lending option, secured by future equity, provides much-needed capital during financially challenging periods. For those who rely on freelance or gig work, understanding title loans can empower them to access immediate funds, enabling stability and growth in their careers. Explore these solutions to navigate financial hurdles and thrive despite the nontraditional nature of their work.

- Understanding Title Loans: A Unique Financial Option

- Freelancers' Needs: Navigating Unstable Income Streams

- Empowering Nontraditional Workers: Access to Capital Solutions

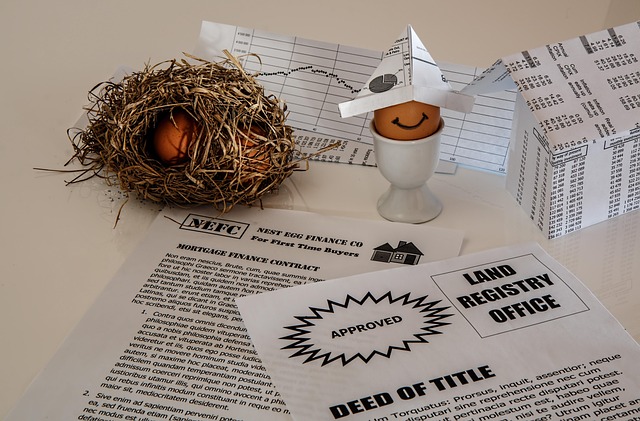

Understanding Title Loans: A Unique Financial Option

Title loans for freelancers offer a unique financial option for nontraditional workers who may struggle to access traditional banking services. This alternative lending approach is secured by an individual’s vehicle, providing a flexible and accessible way to obtain short-term funding. Unlike other loan types, these loans don’t typically require a credit check, making them viable for those with limited or poor credit histories.

In cities like Fort Worth, where the freelance economy thrives, motorcycle title loans have gained popularity as a rapid solution. The process is straightforward: borrowers can use their vehicle’s title as collateral to secure a loan. Once approved, they gain immediate access to funds, which can be particularly beneficial during unpredictable work periods or unexpected financial emergencies. This option allows freelancers to maintain control of their vehicles while gaining much-needed capital.

Freelancers' Needs: Navigating Unstable Income Streams

Freelancers face unique financial challenges due to their nontraditional work arrangements and variable income streams. This instability can make it difficult to predict cash flow and plan for future expenses, including unexpected costs like medical emergencies or vehicle repairs. Many freelancers turn to unconventional financial solutions, such as Title loans for freelancers, to bridge these gaps.

One of the main benefits of a title loan for freelancers is its accessibility. Unlike traditional bank loans that often require extensive documentation and credit checks, online application processes for motorcycle title loans are more flexible. Freelancers can use their vehicle’s title as collateral to secure a short-term loan, providing them with a fast and reliable financial solution when they need it most. This alternative financing option allows them to maintain control over their assets while accessing the capital needed to navigate their fluctuating income.

Empowering Nontraditional Workers: Access to Capital Solutions

In today’s dynamic economy, many workers opt for freelance or independent contracting roles, offering flexibility but also presenting unique financial challenges. Traditional banking options often overlook this nontraditional workforce due to their lack of stable employment and inconsistent cash flow. However, innovative solutions like title loans for freelancers are stepping in to empower these individuals by providing access to much-needed capital.

This alternative financing method offers a lifeline to those with limited options. It provides quick funding, catering to the urgent financial needs of freelancers. Unlike conventional loans, title loans do not heavily rely on credit scores, making them accessible even for those with bad credit loans. The loan terms are flexible and tailored to the borrower’s schedule, allowing freelancers to manage their finances while continuing their work without interruptions. This support is crucial in helping nontraditional workers navigate financial obstacles and thrive in their careers.

Title loans for freelancers offer a unique and empowering solution for nontraditional workers navigating unstable income streams. By providing access to capital, these loans empower individuals to seize opportunities, manage unexpected expenses, and secure their financial future. In a world where traditional banking may fall short, understanding title loan options can be a game-changer, supporting freelancers in their quest for economic stability and success.